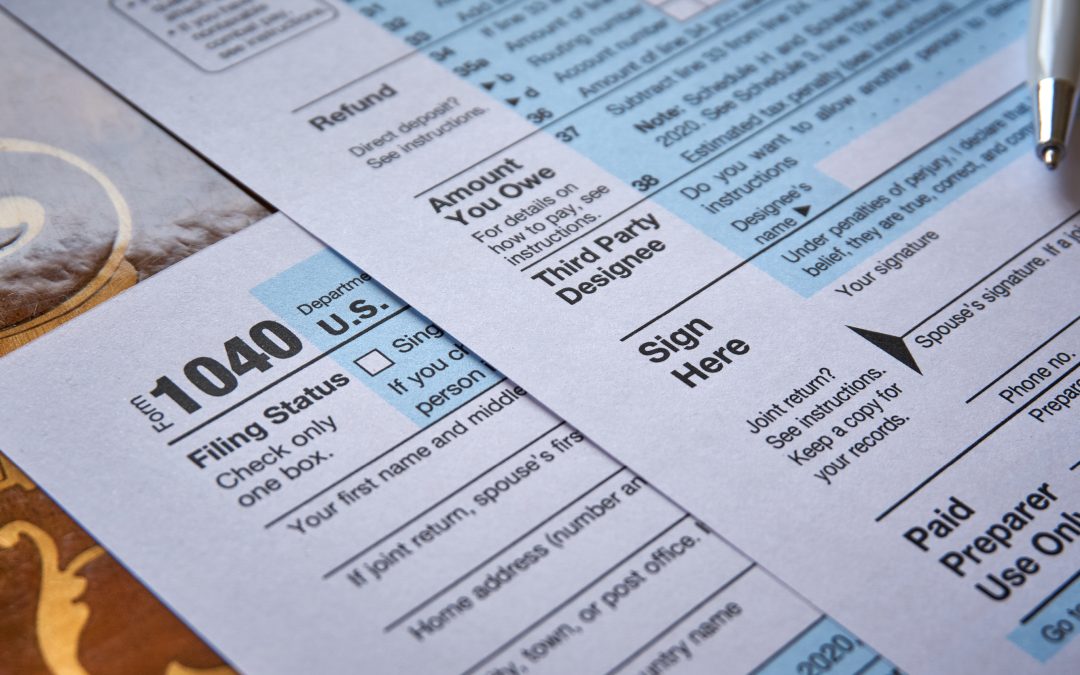

When it comes to working on your taxes, earlier is better, but many people find preparing their tax return stressful and frustrating and wait until the last minute. If you've been procrastinating on filing your tax return this year, here are eight tips that might help. Don't Delay Resist the temptation to put off your taxes until the last minute. Your haste to meet the filing deadline may cause you to overlook potential sources of tax savings and will likely increase your risk of making an error. Getting a head start (even if it is a week or two) will keep the process calm and mean you get your return faster by avoiding the last-minute rush. Gather Tax Documents in Advance Make sure you have all the records you need, including W-2s and 1099s. Don't forget to save a copy for your files....